- posted: Mar. 20, 2020

- Archive, Articles, Business Counseling, Employment, High Technology Law, Business, Uncategorized, Copyright, Small Claims, Political, Business Law, Crowdfunding, JOBS Act, Jumpstart Our Business Startups Act, Business of Media, Trade Secrets, Consumer Credit, Trademarks, Securities Act, Securities Exchange Act, Incorporation/LLC, rights of publicity, Employment Law, Business Litigation, Intellectual Property

As of March 16, 2020, everyone has been urged to work from home, if possible, and it is likely to last several weeks, or even months. Here are some things a small business owner can or should do to maintain operations and protect the business during this time.

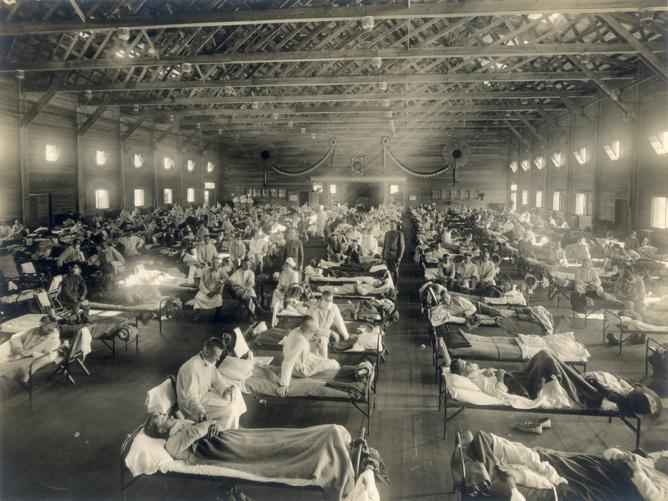

[caption id="attachment_3103" align="alignleft" width="268"] Figure 1 Camp Funston, at Fort Riley, Kansas, during the 1918 Spanish flu pandemic Source: Wikimedia Public Domain[/caption]

Figure 1 Camp Funston, at Fort Riley, Kansas, during the 1918 Spanish flu pandemic Source: Wikimedia Public Domain[/caption]

The media is full of stories about how unprecedented this pandemic is, but that’s not really true. Humanity has suffered many pandemics, from the Black Plague of the 13th and 14th centuries, to the “Spanish” flu (it didn’t develop in Spain – it was only hidden from public view until it affected Spain) 100 years ago. For most of American history, a substantial portion of deaths came from infectious diseases like tuberculosis, malaria, influenza, and yellow fever. The US Supreme Court has closed its doors three times in its 230 years of history – twice for yellow fever and once for the Spanish flu.

What is unprecedented is how much readier society is for a pandemic than in the past. We know that isolation is effective at slowing the transmission of the virus. We can communicate better than we ever have before. People can work from home, and students can still learn at a distance. We don’t have a vaccine yet, but our pharmaceutical industry is turning its considerable research powers to finding one. If we can slow the transmission of the virus long enough, we can get a vaccine to protect those who hadn’t contracted the virus, saving hundreds of thousands of lives here in the US, and millions worldwide.

Until, then, though, business has to keep going. This article will be the first in a series, giving options to small business owners.

- Communication. If you are not going to be able to see everyone on a daily basis, it will be important to establish good communication with everyone, who may not have a working phone. Every employee should be in contact with someone else from the business at least twice a day. Bay Oak Law has been at least partially a “virtual” law firm for almost two years now. We use an Internet-based communication system, like RingCentral or Ooma (see this humble Ooma endorsement), to maintain contact. The business pays for the service, and everyone on our system gets their own separate line, accessed by a free app on their cell phone. Clients and opposing counsel don’t know that we are far from the office – even halfway around the world. Conference calls are free and easy to access – a great tool to “meet” with staff when everyone is at home. We’ve found it to be equal in cost to a regular phone system, and not having to maintain a phone system is definitely a plus. To improve workflow, we also use workflow software like Slack or Microsoft Teams. This provides a sense of community when everyone is separated. It gives us a chance t0 “talk” among ourselves during conference calls with opposing counsel, or even calls with judges (which are going to be much more common going forward).

- Reimbursing Employees for Costs. Reimbursements include far more than just mileage. Cal. Labor Code § 2802 states that “[a]n employer shall indemnify his or her employee for all necessary expenditures or losses incurred by the employee in direct consequence of the discharge of his or her duties . . . .” By staying at home to work, your employees will probably be using assets that they’ve paid for, such as cell phones and usage plans, computers, software, etc., and the employer needs to reimburse the employee for those costs. Check with your accountant or bookkeeper, as some of these costs can be prorated – for example, the employer might have to pay for only a portion of a monthly cell phone or internet plan, as the employee probably already uses them for personal purposes. Check with your employees regarding consumables like paper and the liquid gold known as toner – it’s expensive.

Besides the reimbursable costs themselves, there are substantial penalties for not reimbursing employees -- $100 for the first pay period violation, and $200 for each one after that under Cal. Labor Code § 558, plus the employee’s attorneys’ fees. If this happens to just 1 employee over a year’s time, the penalties alone could be $4700, plus the unpaid reimbursements, plus interest and attorneys’ fees. Multiply that by the number of employees you have, and you can see that it can get expensive very quickly.

Employers who announce a reimbursement program for working from home now, will probably find grateful employees willing to accommodate this extraordinary time. It’ll be worth it.

Worker’s Comp Applies at Home, Too. Employers have a duty to provide a

- safe workplace – and that applies when employees are working from home, as well. Check with your worker’s comp insurer to make sure that your insurance covers working from home. In the interim, feel free to copy and paste the following into an email to send to your employees working from home:

“[Name of business] appreciates your cooperation by working from home during this extraordinary time. Although you are working from home, we still want you to work in a safe work environment. Make sure that your furniture is comfortable and won’t cause eye or body strain, and that dangers like extension cords won’t endanger you. Please take a photo of your designated office space so that we can be sure that you are in a safe location. You still need to take regular rest breaks, including a meal break if your shift is longer than five hours, and work only your assigned hours unless your supervisor authorizes overtime. In addition, you should check your homeowner’s policy is up-to-date, and provide us a copy for insurance purposes.” - Some Resources. If your business has had a severe cutback, contact the California Employment Development Department to see if your business qualifies for the Work Sharing Program. The EDD also has a program specifically for employees who cannot work. Workers who have to be laid off, but can be expected to work sometime soon, do not have to show that they have been seeking work – which will be pretty hard to do under a shelter in place order.

- Working with Creditors. If you are suffering a cash crunch, don’t wait until a creditor like a landlord or supplier is knocking on your door. Contact them early and be frank about your situation. Your creditor is likely to be having problems, too.

- Check your contract or lease – there may be a force majeure or “Act of God” clause that allows you to reduce or avoid payment. Even if there isn’t, you still have leverage to negotiate a temporary, lower payment; right now, there probably aren’t that many good alternatives for your creditor. If you can meet their minimum needs, they will probably work with you.

- Focus on the unsecured debts first – things like credit cards, for example. They have even less leverage than usual, as courts are not going to be eager to enforce their rights in this extraordinary time. Be friendly, be fair, but know that they know that they will have to make compromises, too.

- In much of California, evictions and foreclosures are on hold for the safety of the deputies that carry them out. This will take away the leverage of the creditors. Utilities are currently blocked from removing service; in a pinch, that may be one place to conserve your cashflow.

My grandparents faced a lot of challenges during World War II – both my grandfathers were sailors in wartime, and my grandmothers both had to care for small children single-handedly (and for my grandmother Smith, the Navy transferred her from Pearl Harbor, to San Francisco, to San Diego, to Los Angeles, to back East, then back to San Diego, and Seattle, then back to San Diego). They had ration books for food, gas, and other goods. They got through it, and they are now called the Greatest Generation. Let’s rise to their level.